Develop a Global Macro Perspective to Optimise Asset Allocation Management

In times of frequent occurrence of “black swans”, we understand that the choices made by individuals are closely related to the macro trends, especially for senior managers of financial institutions and enterprises, and that the strategic decisions of those in command are constantly being tested. The financial industry is also more demanding than other industries in terms of professionalism. In the times ahead, in order not to become obsolete, it will be more important for individuals and companies to keep upgrading their financial expertise, to take a broader view of the future and to see the road ahead to stay in touch with the times.

The Financial Markets and Portfolio Management (FMPM) programme at the HKU Institute for China Business is designed to provide a quality learning experience with an emphasis on theory and practice, focusing on "Develop A Global Macro Perspective to Optimise Asset Allocation Management". Today, our FMPM alumni are everywhere in the banking, securities, insurance, asset management, and other financial sectors in Mainland China.

Wealth appreciation is the increase in the aggregate value of different asset classes, including fund investments, ETFs, stock trading, offshore funds, alternative investments, property investment insurance, and medium to long-term investments. The programme provides a systematic approach to teaching financial markets and portfolio strategies. Top traders may have different trading strategies, but they all share a common trait of looking for entry opportunities with a trading edge, and for these top traders, risk management is the basis of all trading. The programme also offers knowledge on private equity and venture capital for students who wish to start their own business.

The new era in the financial markets into which we have just entered has led to the following four features:

The arrival of a game-changing moment in the world of finance

The inclusion of China A-shares in the MSCI Morgan Stanley Capital International Index

The "Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area" place the Hong Kong Financial Centre in a key position and spread its spirit across the country

The growth of FinTech leading to excellence in financial institutions

The programme is accredited by CPA Australia. Upon completion of the programme, students can apply for membership in CPA Australia and get a head start on their professional career.

Partner Programme with CPA Australia:

• Eligibility to apply for membership in CPA Australia with a membership certificate

• Exempt from CPA Australia Foundation courses and no examination fees

• Eligibility to apply for an AICPA scholarship worth approximately 5,000RMB

* This programme is only open to students with a bachelor's degree or above in the discipline and three years of relevant work experience.

* The final decision on this programme rests with CPA Australia.

Programme Design

Financial Market Analysis: Gain insight into the changes and opportunities in the global market and keep track of economic investment trends

Global Wealth Management: Grasp cutting-edge financial market development and facilitate asset allocation and succession

Financial Risk Management: Develop a scientific system for investment management and promote the optimal combination between industry and finance

Programme Content

- Inauguration Ceremony-cum-Residential Workshop

- Macroeconomic and Investment Analysis

- Quantitative Methods in Portfolio Management

- Equity and Fixed Income Analysis

- Derivatives and Trading Strategies

- Private Equity and Venture Capital

- Financial Technology and Artificial Intelligence Algorithm

- Green Economy and ESG Investing

- Global Wealth Management

- Wealth Planning and Succession

- Investment Risk Management and Portfolio Optimisation

- Final Project

Teaching Members’ Qualifications

In addition to senior professors from the University of Hong Kong, there are also investment executives from various renowned financial institutions and multinational corporations such as Lyon Securities, Credit Suisse, Royal Bank of Scotland, BNP Paribas, Cathay Financial Holdings, PricewaterhouseCoopers, HSBC, and General Electric. All faculty members have extensive experience in financial markets and investment management in Mainland China, Hong Kong, Taiwan, and overseas institutions, and can provide students with a full range of professional training and practical guidance.

陆晨博士

Dr Chern Lu

Adjunct Associate Professor; Distinguished Professor of Business Psychology at Harvard University; Distinguished Advisor of Hong Kong International Family Office Association; Applied Math Ph.D of Courant Institute of Mathematical Sciences, NYU

杨文斌先生

Mr Philip Young

Adjunct Associate Professor; Senior Consultant, Oliver Wyman; Independent Director, OCBC Wing Hang Bank and HDFC Fund Management; MBA from University of Chicago Business School

邱良弼先生

Mr Spencer Chiu

Adjunct Associate Professor; Head of Investment at Franklin Hua Mei Securities; Master's degree in Financial Management and Information Management from New York University

关启正博士

Dr Zenki Kwan

Academic Advisor of the programmes in the Family Office Centre; Adjunct Associate Professor; Veteran Investment Officer of Family Office in Hong Kong; Veteran Investment Banker (J.P. Morgan, UBS)

邹宇先生

Mr Jimmy Chow

Part-time Lecturer; Former Director of JPMorgan and Citibank, N.A.; Director of Rothschild Family Bank, Asia; Master of International Finance, Columbia University, U.S.A.

李国平先生

Mr Guoping Li

Part-time Lecturer; Director of the Digital Economy and Fintech Research Institute at Baiwang Cloud; Former Senior Financial Industry Executive for Greater China at Microsoft; Senior Researcher at the Delta Fintech Research Institute

林浩文先生

Mr Thomas Lam

Part-time Lecturer; Chartered Surveyor; General Manager of Asset and Portfolio Management, New World Development Company Limited, with over 25 years of experience in the real estate industry in the Mainland, Hong Kong, China & Asia Pacific markets

孙志鹏博士

Dr Zhi Peng Sun

Part-time Lecturer; Former Director of Product Design, Lufax, a leading financial technology and internet wealth management platform in China; PhD, Columbia University, USA

高翠芬女士

Ms Gina Kao

Part-time Lecturer; Former Senior Manager, China Tax, Ernst & Young; with over 25 years of teaching experience in Finance

甘启善先生

Mr Andrew Kam

Part-time Lecturer; Partner / Managing Director (China Market); Printemps Investment & Management Group Ltd, Singapore and Director of the Royal Institution of Chartered Surveyors China Board

楼仙英女士

Ms Cecilia Lou

Part-time Lecturer; Head of IP at King & Wood Mallesons; Board Member of the Shanghai Intellectual Property Services Association (SIPSA) and the Licensing Executives Society (LES) China

谢雅妃女士

Ms Afre Xie

Part-time Lecturer; Managing Partner at Fuhong Capital; Former Chief Investment Officer of a Single-Family Office; MSc in Financial Management and Accounting (Honors), University of Leicester, UK

许嘉铭先生

Mr Joe Hui

Part-time Lecturer; Investment Director, Quantitative Division, Hawkeye Group

江昕博士

Dr Eric Chiang

Part-time Lecturer; Former Executive Director of Asset & Wealth Management at Goldman Sachs; MIA and Master of Business Administration (MBA), Columbia University

吴大有博士

Dr Ta Yu Wu

Part-time Lecturer, Head of an initiating unit of the International Institute for Advanced Data Management; Initiator of the Global Data Factor 50 Forum; Member of the board of directors of DAMA China

梅鹏坚先生

Mr Patrick Mui

Part-time Lecturer; CIO of Family Office and Head of Venture Capital Fund, specialising in A.I. and Web3.0 investments; Master degree from University of Oxford, UK

曹阔博士

Dr Max Cao

Part-time Lecturer; Founder & CEO of Golden Data Ltd (UK) and its China branch, YingKeZhuShu Network Technology Co., Ltd; Developer of DPLUS Industrial Digital Platform; PhD in Computer Science & Material Sciences, University of Manchester

徐超先生

Mr Alan Xu

Part-time Lecturer; Investment Director of Kunpeng Holding Group; MBA from Cornell University and Tsinghua University

李国樑先生

Mr Paul Li

Part-time Lecturer; Senior FinTech industry expert; General Manager of Greater China at Banking Circle, Master of Information Technology at Royal Halloway, University of London

卢铭恩先生

Mr Leo Lo

Part-time Lecturer; CEO, Fonto Holdings Limited; Managing Director, CHFT Advisory and Appraisal Limited; Founder, Asia PropTech

许峻铭先生

Mr Junming Xu

Part-time Lecturer; Founding partner and CEO of Vista Private Equity Fund Management Company; Deputy director of the Finance Committee of the Beijing Dongcheng District Committee of the China Democratic National Construction Association

Programme Highlights

The programme combines theoretical knowledge of investment with practical experience and cases to cultivate students with keen market insight and professional investment analysis ability. Through systematic learning, students will be able to understand a variety of investment tools and risk management methods, establish an optimal investment and wealth management portfolio, and effectively face the challenges of the market to grasp the financial opportunities.

Global Perspective

Leading students to gain insights into global market developments, mastering the latest financial instruments, raising awareness of risk management, and providing the best investment strategies.Practical Cases

Highly qualified professional faculty members make full use of their extensive international experience in investment and financing, combined with the specific situation in Mainland China, turning theories into effective real-life practices. By focusing on both theories and practical exercises, students can further assess financial risks, construct effective asset portfolios, and effectively achieve their investment objectives.Cutting-edge Investment Knowledge and Scientific Analysis

Analyse and evaluate asset appreciation options, leading property and REIT from complex financial data.

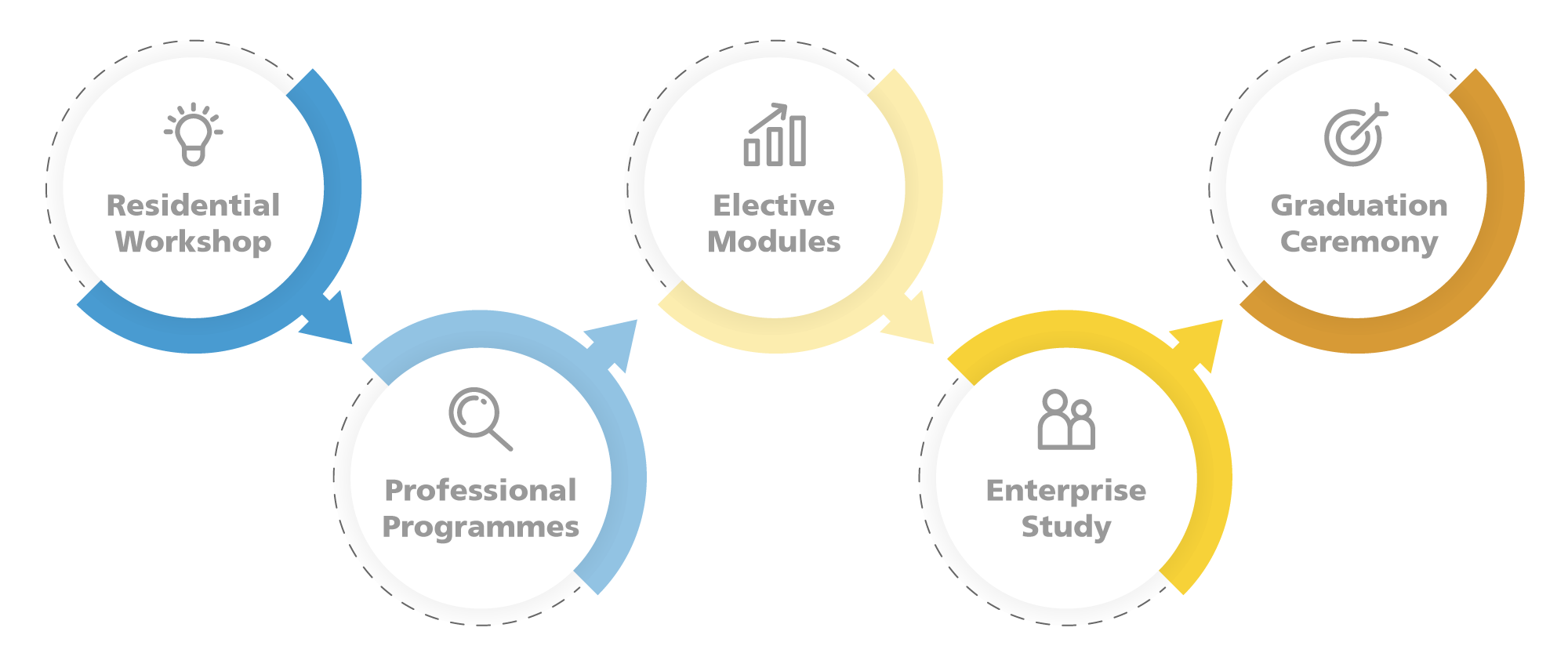

Learning Journey

Learn More》 Elective Modules Enterprise Study

Suitable for

This programme is not only suitable for professional managers with years of experience in financial market operations, investment management or financial services, as well as general managers who wish to build systematic portfolio funds including family and corporate investment decision makers, finance directors/managers, investment risk control managers and professional financial institution service providers, but also for middle and senior managers with the need for cross-function financial market operations.

Alumni

Previous students of this programme came from major companies including: Tencent, Alibaba, Ping An Insurance, ByteDance, China Merchants Bank (CMB), BYD, NetEase, Xiaomi, Huawei, China Mobile, China Telecom, Baidu, ANTA, Everbright Securities, CITIC Securities, Industrial Securities, GF Securities, Guotai Junan Securities, New Oriental, iFLYTEK, China Resources Shenzhen International Trust, Fosun Pharma, Kingdee, WeDoctor, Xiaohongshu (Little Red Book), VIVO, DXC Technology, eBay, Dianzan.com, Oppein, Xtep, Dongpeng Beverage, Yangtze River Pharmaceutical, United Family Healthcare, GDS Holdings, Belle International, H&T Intelligent Control, Born, J.P. Morgan, Ele.me, Kingstar, DR, Sinopharm, Medtrum Medical, Junlikang Medical, Daikin, Chint New Energy, Pure & True Dairy, Omron, UNNY Biotech, Merck, Suzhou EasyDeLon, Hangzhou United Bank, DBS Bank, OneConnect, World Union, China Zheshang Bank, Tianneng Leasing, Kaibo New Materials, Eurofins Scientific, Jiangsu Yunyi Electric, Happy Entertainment, Lead Fund, Road King Infrastructure, KJT Payment, Bank of Ningbo, Anzhong Heavy Industry, Amkor Assembly, Fanchang Rural Commercial Bank, Huasheng Securities, Lujiazui Property, Great Wall Securities, Huafu Securities, ICICI Bank, Jiangsu Xintianlun Law Firm, Beijing Yingke Law Firm, Shanghai Yucheng Law Firm, Unis Digital, CreditEase Wealth, State Taxation Administration, Ningbo Art Museum, etc.

Graduation Certificate

Postgraduate Diploma in Financial Markets and Portfolio Management

Upon completion of the "Residential Workshop", 10 compulsory modules and the "Financial Markets and Portfolio Management Final Project", and after passing the evaluation, students will be awarded the "Postgraduate Diploma in Financial Markets and Portfolio Management" by the University of Hong Kong at the postgraduate level.

Fees and Charges

| Application fee: | 500 RMB |

| Tuition fee: | 118,000 HKD |

| Meals and travel expenses: | Students are responsible for their own accommodation and transportation during the programme. If the Inauguration Ceremony-cum-Workshop is held offline, accommodation during the period will be arranged by the Institute and the costs will be covered accordingly. |

Programme Enquiries

| Becky Yang - (010) 6596 9976 |

| Cherry Wu - (021) 6841 6189 |

| Lisa Ouyang - (0755) 2360 9771 |

| Catherine Fan - (020) 2206 0511 |

| Ania Ai - (028) 8445 7289 |